Las Vegas Sands ‘High Dispersion’ Favorite at Goldman Sachs

In light of worries regarding the condition of the US/China trade ties and the robustness of the Macau recovery, Las Vegas Sands (NYSE: LVS) is experiencing turbulent times, evidenced by a year-to-date drop of 15.56%. Despite those challenges, the stock has its advocates.

In a recent report, Goldman Sachs stated that investors aiming to possibly outperform the overall market should think about high-dispersion stocks within the communication services, consumer discretionary, and technology sectors. Consumer cyclical is the sector where gaming stocks like Sands are located. Dispersion refers to a statistical measure, and when it is elevated, it suggests that the different possible outcomes are extensively distributed.

"S&P 500 annual return dispersion in 2024 rose to 70 percentage points, the highest level outside of recessions since 2007,” notes Goldman Strategist David Kostin. “High return dispersion reflects a favorable stock-picking environment.”

According to Goldman Sachs, Sands has a dispersion score of 6.1, which exceeds the S&P 500 median of 2.0 by over three times. The operator of the Venetian Macau is the sole gaming company on the bank's list of appealing high-dispersion stocks.

Policy Uncertainty Pressuring Sands Stock

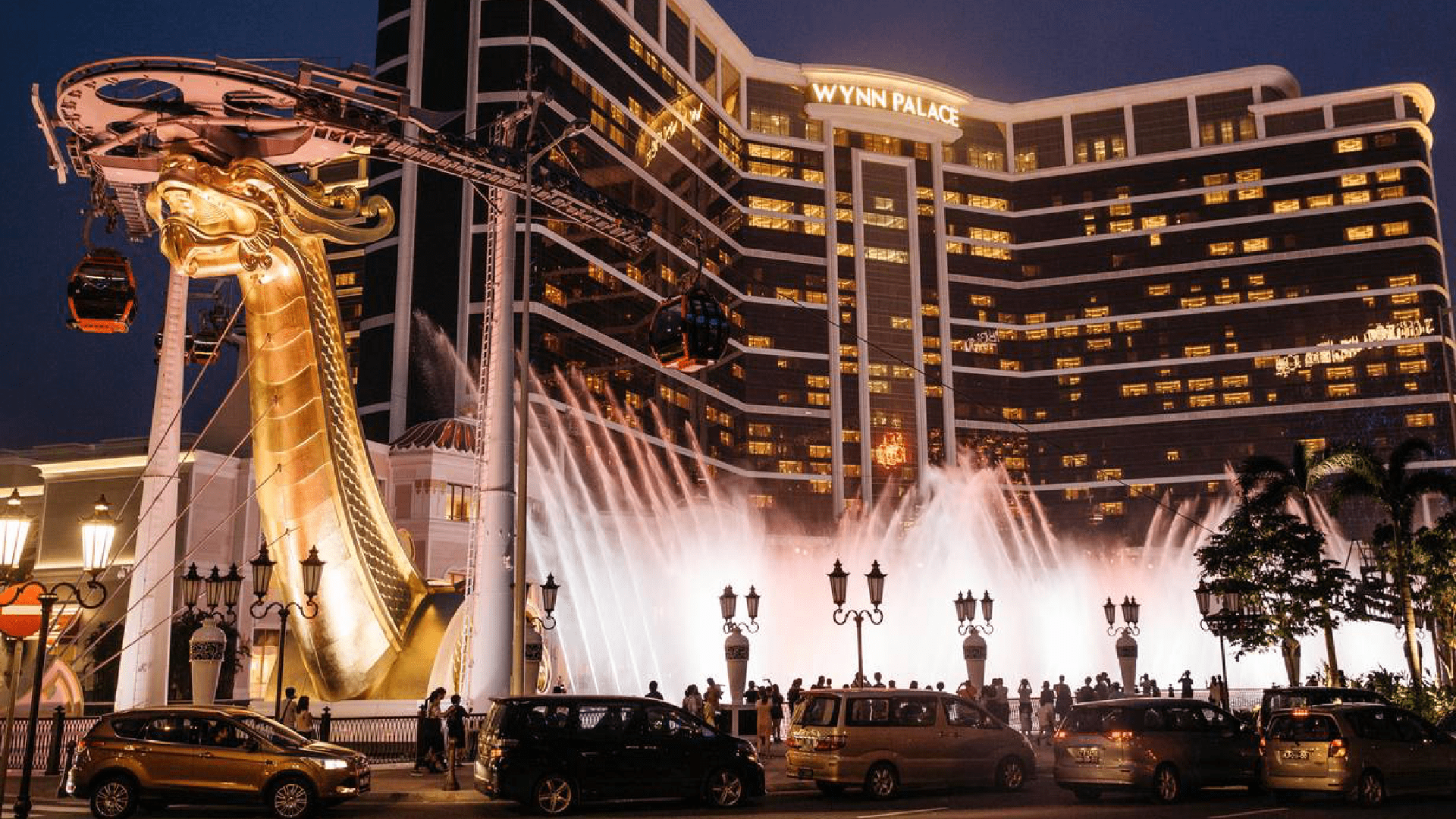

A key challenge for Sands stock is President Trump's approach to China — Macau’s largest feeder market where the company operates five casino hotels. The president has indicated he is prepared to use trade tariffs on China, which has suggested it will react similarly.

“Typically, higher levels of economic policy uncertainty coincide with higher levels of return dispersion as investors discern the winners and losers of proposed economic policy,” adds Kostin.

This is a film that Sands investors have seen before. In his initial term, Trump directed severe language towards China, leading then LVS Chairman and CEO Sheldon Adelson to caution the president to soften his tone or face potential defeat in the 2020 election. During several instances in August 2019, Adelson allegedly contacted Trump, encouraging him to soften his stance on China.

Trump eventually lost his attempt for reelection in 2020. Dr. Miriam Adelson, the widow of Adelson, continued to be a strong supporter of Trump and was among the top financial contributors to his successful 2024 presidential campaign. She is additionally the biggest single shareholder in the gaming firm.

High-Dispersion Stocks Are Not for the Easily Discouraged

Goldman's Kostin notes that high-dispersion stocks "can produce significant alpha via underperformance just as they can through outperformance." The suggestion is that although Sands provides investors with the potential for alpha generation, it might also experience volatility affecting its performance compared to the wider market.

That being said, Las Vegas Sands has its backers, with some thinking the shares present considerable upside potential.

"Bottom line is we see a clear path to $60+/share in the near term as investors grow more comfortable with the Macau/Singapore landscape,” wrote Stifel analyst Steven Wiecyznski in a recent note. “As we look across our coverage, Macau-centric names should be a group that outperforms this year given the fact demand patterns should accelerate which could translate into positive estimate revisions.”

While the analyst reduced his price target for Sands to $64 from $66, the revised price goal offers significant potential upside from the stock’s close on February 14 at $43.37.