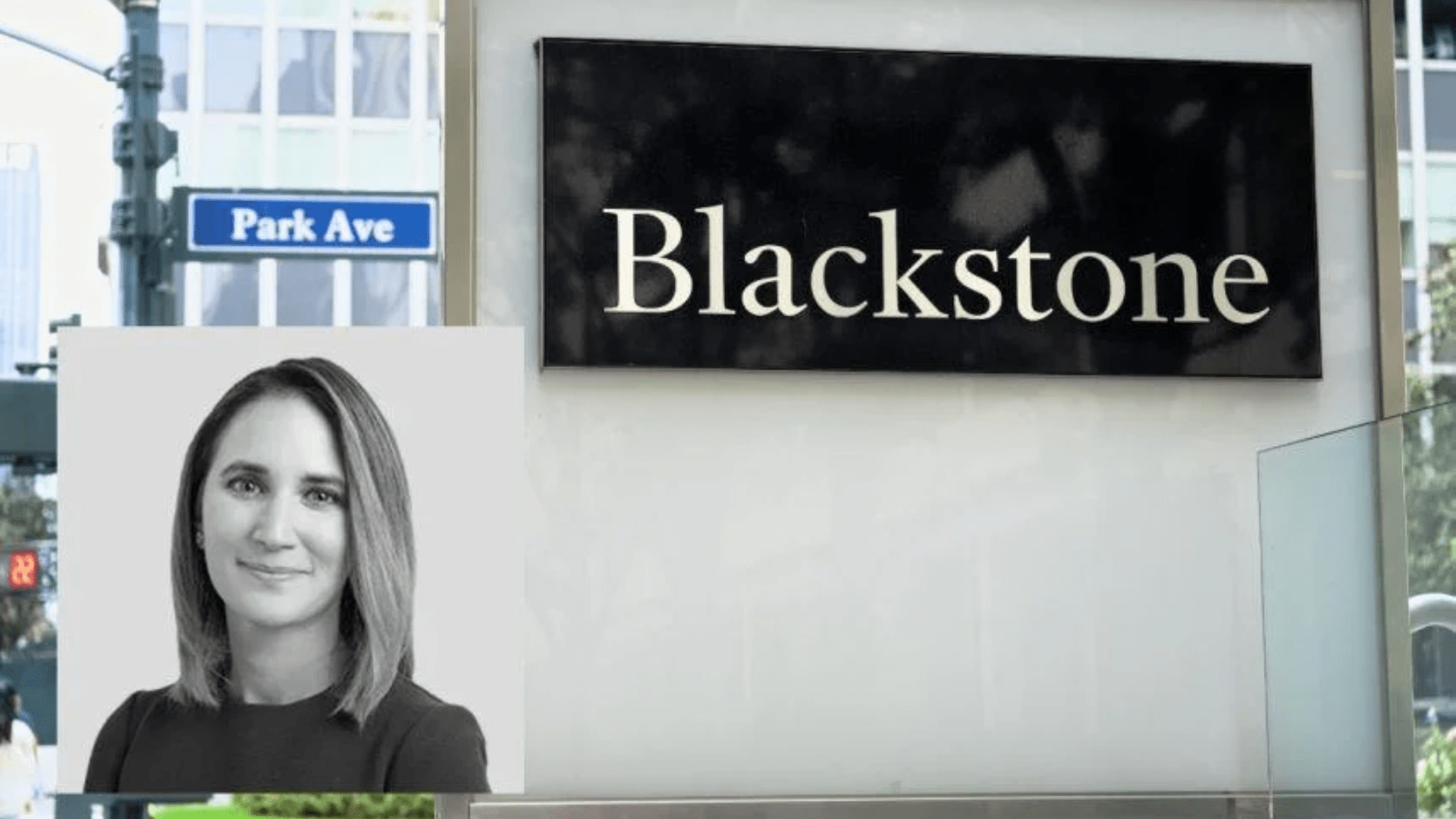

Blackstone Mourns REIT CEO Wesley LePatner, Whose Division Led Casino Acquisitions

Monday's deadly shooting inside an office building in Midtown Manhattan claimed the life of a senior executive at the private equity firm Blackstone.

The gunman, 27-year-old Las Vegas native Shane Tamura, is suspected by the New York Police Department (NYPD) and Mayor Eric Adams of targeting the NFL's headquarters inside the office building at 345 Park Avenue. However, Tamura rode the incorrect elevator to the 33rd level. New York Governor Kathy Hochul (D) said he was armed with a “AR-15-style assault rifle” and started shooting after entering.

According to Blackstone, one of Tamura's four victims who perished in the assault was Wesley LePatner. LePatner oversaw Blackstone Real Estate Income Trust (BREIT) as its CEO.

"We are heartbroken to share that our colleague, Wesley LePatner, was among those who lost their lives in the tragic incident. Words cannot express the devastation we feel. Wesley was a beloved member of the Blackstone family and will be sorely missed,” a statement from Blackstone read.

“She was brilliant, passionate, warm, generous, and deeply respected within our firm and beyond. She embodied the best of Blackstone. Our prayers are with her husband, children, and family. We are also saddened by the loss of the other innocent victims as well, including brave security personnel and NYPD,” the statement continued.

Tamura reportedly left a note asking for his brain to be examined and expressing his sadness, according to law officials. According to reports, the attacker had catastrophic brain injuries and mental health problems that he attributed to his high school football playing days.

Stephen Schwarzman, the founder and CEO of Blackstone, referred to yesterday as the "worst day in the firm's 40-year history."

Investments at Blackstone Casino

Blackstone's real estate investment trust branch was headed by LePatner. In 2014, she joined Blackstone, one of the biggest private equity firms in the world.

LePatner held the positions of worldwide head of BREIT's Core+ Real Estate, member of Blackstone Real Estate's Investment Committee, and CEO of BREIT.

Blackstone made significant investments in the US gambling sector under her direction, mostly through Las Vegas. In 2020, Blackstone entered into an agreement with MGM Resorts’ REIT, MGM Growth Properties, to purchase 49.9% of the physical real estate assets of MGM Grand and Mandalay Bay. When Caesars’ REIT, Vici casinos, purchased MGM Growth a year later, Blackstone liquidated its interest in the casinos.

MGM's Bellagio was purchased by BREIT for $4.25 billion prior to the COVID-19 epidemic under a sale-leaseback agreement with $245 million in yearly rent. In August 2023, Blackstone sold roughly 22 percent of the property for $950 million.

Just months after LePatner joined BREIT in a $1.73 billion deal, Blackstone purchased The Cosmopolitan, a resort on the Strip. In 2022, BREIT sold the opulent resort for $5.6 billion after investing over $500 million in it. MGM paid $1.6 billion for its operations, while the Cherng Family Trust, which is led by the Panda Express founders, paid $4 billion for the site. After the divestment, Blackstone kept a tiny portion of the business.

Housing in Las Vegas

Blackstone is also a significant investor in residential real estate in Southern Nevada. Rents and housing costs have increased as a result of the company's optimistic real estate investments in Las Vegas since the outbreak.

For $845 million, BREIT sold almost 4,000 housing units to Brookfield Asset Management last December.

Eight percent of the BREIT portfolio is in Nevada. The only states with higher percentages are Florida (13%), Georgia (11%), and Texas (10%).